Higher interest rates are coming. That’s bad news for bond investors, right? Not necessarily. Such a widely held belief can beguile you into making mistakes with your bond holdings.

Who knows when and if higher rates are really coming, in spite of Fed Chair Janet Yellen’s statement that they are on the way later this year? Forget the dozen or so erroneous warnings over the past decade. We also had 13 Triple Crown attempts since Affirmed in 1978, and only this year did a contender, American Pharoah, capture horseracing’s highest honor.

For the first time since June 2006, the Federal Reserve looks primed in the near future. The warning bells are ringing like this one from Fox Business’ website recently: “Lookout Retirees, Here Come Rising Interest Rates.” The piece warns us to adjust our investment strategies as bond prices, which move in the opposite direction from rates, slide.

The basic premise of these warning bells is that a Federal Reserve rate hike will hurt bond returns so much that investors should reduce their bond allocation. Before taking cover and preparing for the impending rate raises, consider some of the faulty logic encouraging investment action.

Fallacy 1: Higher interest rates are coming. The futures market suggests that the Federal Reserve is likely to increase its target for the federal funds rate – which commercial banks charge between themselves for overnight loans – later this year or early in 2016. Most people take this to mean that interest rates are headed higher.

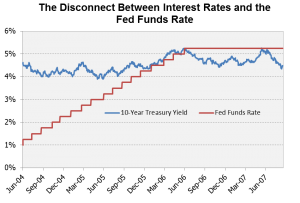

What’s not well understood is that the Federal Reserve does not set or directly control intermediate and long-term interest rates that matter most to bond prices. The federal funds rate affects extremely short-term rates, and thus has a strong impact on the yield of money markets, bank savings accounts and floating rate loans. It has much less influence on longer-term rates, which are a function of bond investors’ trades and market expectations.

We need only go back to the last period of Federal Reserve rate hikes, which began in June 2004, for a clear example of the disconnect between the fed funds rate and longer-term interest rates. On June 29, 2004, the day before the Federal Reserve began to increase rates, the 10-year U.S. Treasury yielded 4.7%. Within three months of the first rate hike, the 10-year’s yield declined below 4.0%.

That is, the Fed increased rates, but bond yields went the opposite direction. A year after the first rate increase, the 10-year Treasury yield remained below 4% despite the fed funds rate increasing by two percentage points over that span. Purchasing a 10-year Treasury the day before the Fed started raising rates and holding it for a year resulted in a return of 10.1%. A 20-year Treasury held over that same time earned 19.2%.

One reason: Back then, the Chinese were eager buyers of long-term Treasuries, which drove up their prices and pushed down their yields. Today, amid troubles in Europe and Asia, long Treasuries are the safe-harbor investment of choice for foreign investors. So much for the concept that you don’t want to own bonds when the Fed is increasing rates.

If the market anticipates that Fed rate hikes are likely to trigger an economic slowdown, recession or simply curtail any inflation pressures, expect longer-term bond yields to decrease, not increase.

Fallacy 2: Higher interest rates will hurt bond returns. This belief holds true in the short-term, but not in the longer-term. If you buy a 10-year Treasury today and you’re seeking the highest nominal return over the next decade, the best-case scenario is that interest rates rise dramatically immediately after you purchase the bond.

This logic flies in the face of traditional short-term thinking because most people associate rising interest rates with lower bond prices. True, the bond price will decline in the short-run and you would have been better waiting to buy the bond after rates increased, not before.

But if rates immediately rise, you will be able to reinvest the coupon payments at higher reinvestment rates over the next 10 years, which will make for a higher holding period return over the bond’s decade-long term than if rates had remained constant or declined. As demonstrated in the figures below, you actually earn an additional $5,460 from a $100,000 over the 10-year period when rates immediately increase by two percentage points rather than immediately drop by two points.

10-Year Scenario if: | Holding Period Return | Ending Value |

Interest Rates Immediately Decline to 0.5% | 2.31% | $ 125,602 |

Interest Rates Remain at 2.5% for 10-Years | 2.51% | $ 128,182 |

Interest Rates Immediately Increase to 4.5% | 2.74% | $ 131,062 |

Fallacy 3: You should sell bonds in advance of Fed rate hikes. As we showed above, bond yields are not directly tied to the federal funds rate. Plus, anyone who sells bonds has to find a replacement investment for the sale proceeds. Cash pays nearly nothing and stock prices have historically provided lackluster results in rate tightening cycles. Also, predicting outcomes is a fool’s errand. Timing the movement of interest rates has dumbfounded investors for decades and is likely to continue doing so.

If you think you know the future path of interest rates, you are better served to open a hedge fund and make outlandish profits, than to simply make a few dollars on your own portfolio. Bonds in a diversified portfolio provide protection in stock market selloffs.

While the Standard & Poor’s 500 lost 36.6% in 2008, an investment in 10-Year Treasuries gained 20.1%. If you’re worried more about sharp portfolio losses than near-term fluctuations, a better idea is to maintain a bond allocation, rather than to abandon this protection.

What do the fallacies of rising interest rates mean to you? Humans are inherently biased to do something, a point that is not lost on Wall Street. People prefer action over inaction, regardless of whether inaction is optimal. Since Wall Street profits from investor activity, there will continue to be warnings of rising interest rates and what you can do to protect yourself. as banks and brokerages have a vested interest in compelling trading activity.

Don’t let public perceptions drive your bond investing. Remember the difference between speculation and investment.

In the words of author Fred Schwed Jr., a stock trader who got out of the market in 1929: “Speculating is an effort, probably unsuccessful, to turn a little money into a lot. Investment is an effort which should be successful, to prevent a lot of money from becoming a little.”

Follow AdviceIQ on Twitter at @adviceiq.

Jason Lina, CFA, CFP is Lead Advisor at Resource Planning Group Ltd. in Atlanta. Website: www.rpgplanner.com.

AdviceIQ delivers quality personal finance articles by both financial advisors and AdviceIQ editors. It ranks advisors in your area by specialty, including small businesses, doctors and clients of modest means, for example. Those with the biggest number of clients in a given specialty rank the highest. AdviceIQ also vets ranked advisors so only those with pristine regulatory histories can participate. AdviceIQ was launched Jan. 9, 2012, by veteran Wall Street executives, editors and technologists. Right now, investors may see many advisor rankings, although in some areas only a few are ranked. Check back often as thousands of advisors are undergoing AdviceIQ screening. New advisors appear in rankings daily.